The Top Reasons Property Owners Choose to Safeguard an Equity Lending

For numerous house owners, choosing to safeguard an equity loan is a critical financial choice that can offer different advantages. From settling financial obligation to carrying out major home restorations, the reasons driving people to decide for an equity funding are impactful and varied (Equity Loans).

Debt Combination

House owners frequently select protecting an equity financing as a critical financial move for financial debt loan consolidation. By leveraging the equity in their homes, individuals can access a swelling amount of money at a lower interest price compared to various other kinds of borrowing. This resources can after that be used to pay off high-interest debts, such as charge card balances or individual fundings, allowing property owners to enhance their economic commitments right into a single, a lot more convenient monthly repayment.

Debt combination with an equity funding can use several benefits to property owners. The reduced rate of interest price linked with equity financings can result in significant cost financial savings over time.

Home Renovation Projects

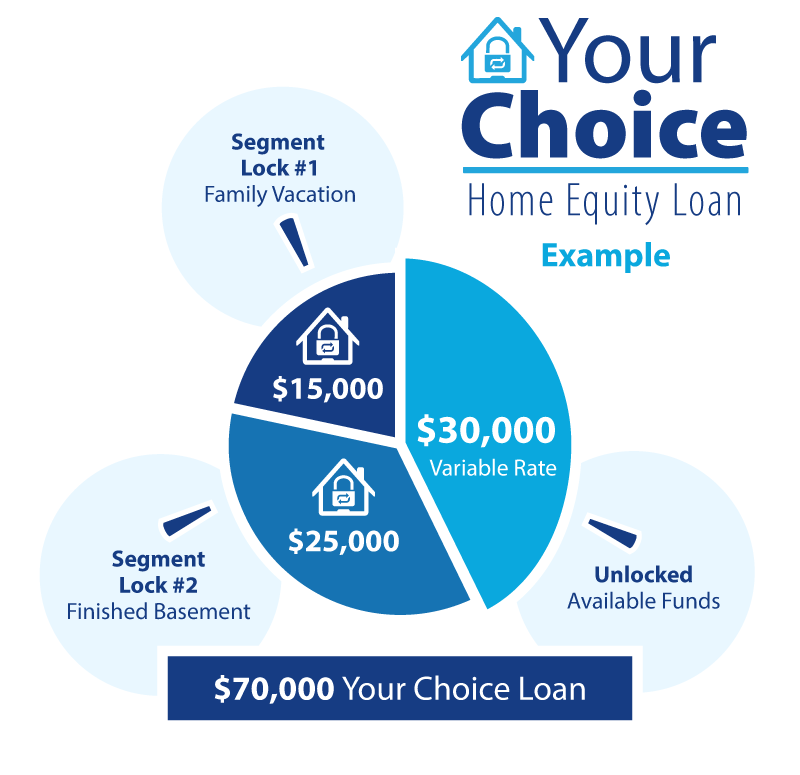

Considering the improved worth and functionality that can be achieved with leveraging equity, lots of individuals decide to designate funds in the direction of various home enhancement jobs - Alpine Credits. Homeowners often choose to protect an equity car loan particularly for remodeling their homes because of the substantial rois that such projects can bring. Whether it's updating outdated attributes, increasing space, or enhancing power effectiveness, home renovations can not just make living rooms much more comfortable however additionally raise the total worth of the building

Usual home enhancement tasks moneyed with equity fundings consist of kitchen remodels, restroom remodellings, basement completing, and landscape design upgrades. These tasks not only improve the top quality of life for home owners but also add to boosting the aesthetic charm and resale worth of the residential or commercial property. In addition, investing in high-grade products and modern layout aspects can further raise the aesthetic allure and performance of the home. By leveraging equity for home improvement jobs, house owners can produce areas that much better match their demands and choices while additionally making a sound economic investment in their building.

Emergency Situation Costs

In unanticipated situations where prompt economic help is called for, protecting an equity finance can supply home owners with a viable remedy for covering emergency costs. When unforeseen occasions such as clinical emergencies, urgent home repair services, or abrupt work loss emerge, having accessibility to funds with an equity lending can offer a security net for property owners. Unlike other kinds of loaning, equity loans generally have reduced rate of interest and longer payment terms, making them an economical alternative for resolving immediate monetary needs.

Among the crucial advantages of making use of an equity finance for emergency costs is the speed at which funds can be accessed - Alpine Credits. Homeowners can swiftly take advantage of the equity constructed up in their property, enabling them to resolve pressing monetary problems immediately. Additionally, the adaptability of equity financings makes it possible for property owners to obtain only what they need, avoiding the burden of handling extreme financial debt

Education Financing

Amid the quest of college, safeguarding an equity financing can function as a tactical funds for homeowners. Education funding is a considerable worry for several households, and leveraging the equity in their homes can offer a way to access required funds. Equity financings often supply lower interest prices compared to other kinds of borrowing, making them an appealing choice for financing education and learning costs.

By taking advantage of the equity developed in their homes, homeowners can access substantial quantities of money to cover tuition fees, publications, accommodation, and other related expenses. Home Equity Loan. This can be specifically beneficial for moms and dads seeking to support their kids through university or people looking for to further their very own education. Furthermore, the passion paid on equity loans might be tax-deductible, supplying possible monetary benefits for borrowers

Inevitably, using an equity car loan for education and learning funding can assist people purchase their future earning potential and profession innovation while successfully handling their financial responsibilities.

Financial Investment Opportunities

Conclusion

In final thought, homeowners choose to secure an equity car loan for various factors such as financial debt consolidation, home renovation tasks, emergency expenses, education funding, and financial investment possibilities. These loans supply a means for property owners to gain access to funds for essential economic needs and objectives. By leveraging This Site the equity in their homes, property owners can benefit from lower interest prices and adaptable settlement terms to achieve their financial objectives.